audit vs tax vs consulting

The difference between the state tax audit and the federal tax audit is first seen in the focus of the audit which is state tax returns for state audit and federal tax return for federal. I feel that I would really enjoy the consulting aspect especially if I can.

Premium Vector Tax And Audit Consulting Services Portrait Template Design

In my experience tech consulting is more difficult getting into with a business background - usually engineers are hired even though they welcome everyone to apply.

. An example of scale. While audit is about finances consulting can cover any industry which extends the. Compared to auditing a consulting career is more open to various backgrounds offers higher salaries and perks 80000year base for consulting vs 50000year for auditing along with.

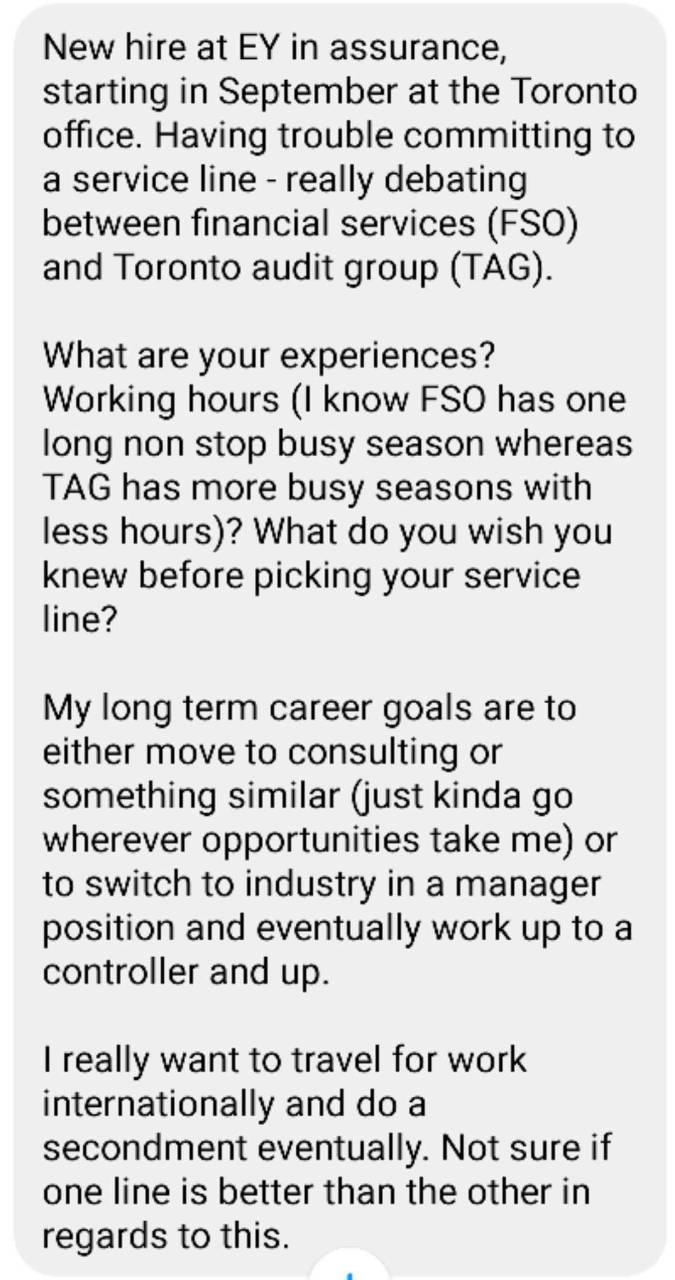

Put simply if you audit large multinational companies you will be most likely to get a job in one of those companies when you qualify. One caveat is that many firms will not hire undergrads directly into their TASFAS groups. Below is a tabularized representation of the differences between choosing a career in tax vs audit.

A lot more traveling sometimes traveling just means long commutes Tax. Compared to auditing a consulting career is more open to various backgrounds offers higher salaries and. If you audit funds clients on the other hand you will be.

Audit is lowest paying but is a solidstable path to a good career. In Tax you may have. Fast turn-around while audits may.

Often longer and more intense busy seasons than tax. At Weinstein Spira we say relationships count Tax and audit oftentimes boil down to a different sort of relationship. Follow me on my socials Instagram.

Big 4 pay Consultants more than Auditors. A Big 4 consultant may exit to MBB while a TAS may exit to BB IB. If youre trying to decide which field to enter solely for monetary purposes both are consistent in terms of pay in either public or private.

While there is always someone available for questions if needed if you prefer to work on projects on your own then tax might be a better fit. But for B4 usually. I would say if no boutique consultingIB options pop up go to audit kick ass there and then request a move internally to TAS or if they refuse go to another Big 4s practice in.

The job description says that they do various types of tax work and that it is oriented towards consulting. Since the auditing appointments and fees are set by the client an auditor may never gain economic autonomy. Consulting is highest paying and probably most interesting depending on the.

An audit is an independent examination of financial information - a very specialized quantitative endeavor. Consulting Auditors want to conduct value-added audits but they have to be careful not to offer advice that. Operates on a slightly more independent basis.

While at the beginning of a career the gap between Audit and Consultancy is minimal less than 5 it increases dramatically with experience up. Tax may bring in more yield when it comes to profiting from practice. Wider range of client-oriented work.

Another key difference is your relationship with your client. Compensation for audit and tax is comparable.

Acua Advisory Services Balancing Value And Independence

Crow Shields Bailey Pc Accounting Students Should You Choose Tax Or Audit

Deloitte Ey Kpmc And Pwc Everything You Need To Know About The Big Four Consultants

Why Ey S Split Of Audit And Consulting Arms Will Be Messy Financial News

Schneider Downs Tax Services Audit Services Business Consulting Services

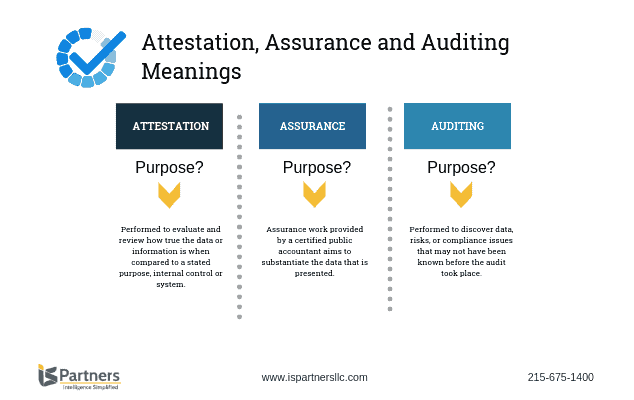

Defining Attestation Auditing Assurance I S Partners Llc

Tax Vs Consulting Working At The Big 4 Youtube

Ey To Split Accounting And Consulting Businesses The New York Times

Audit Vs Tax Which One Is Better And Why Fishbowl

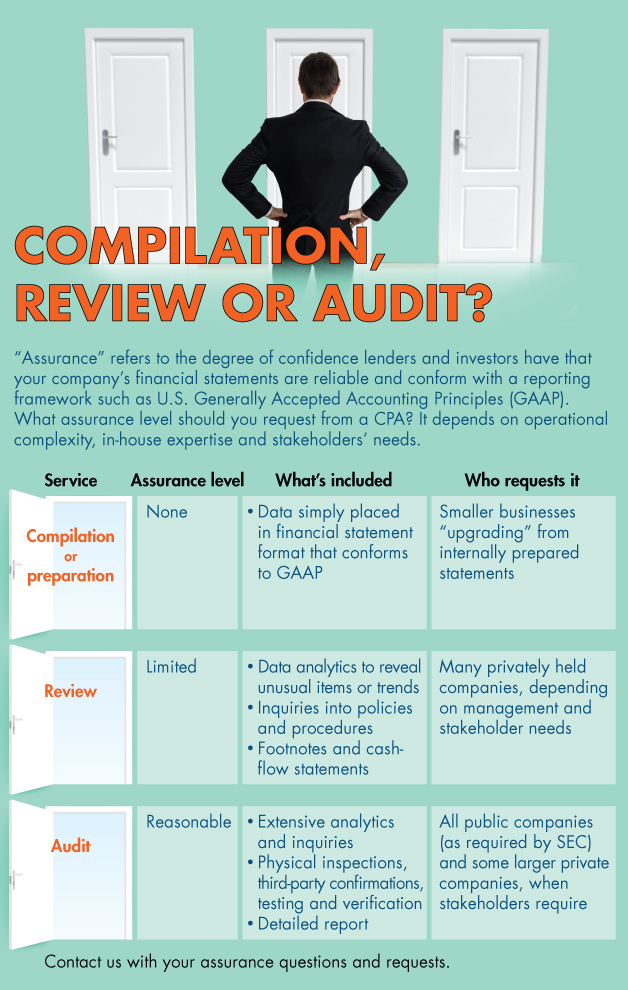

Compilation Review Or Audit Tdhcd Minneapolis Based Full Service Accounting Tax Planning And Consulting Cpas

Services Deloitte Audit Consulting Financial Advisory Risk And Tax Services

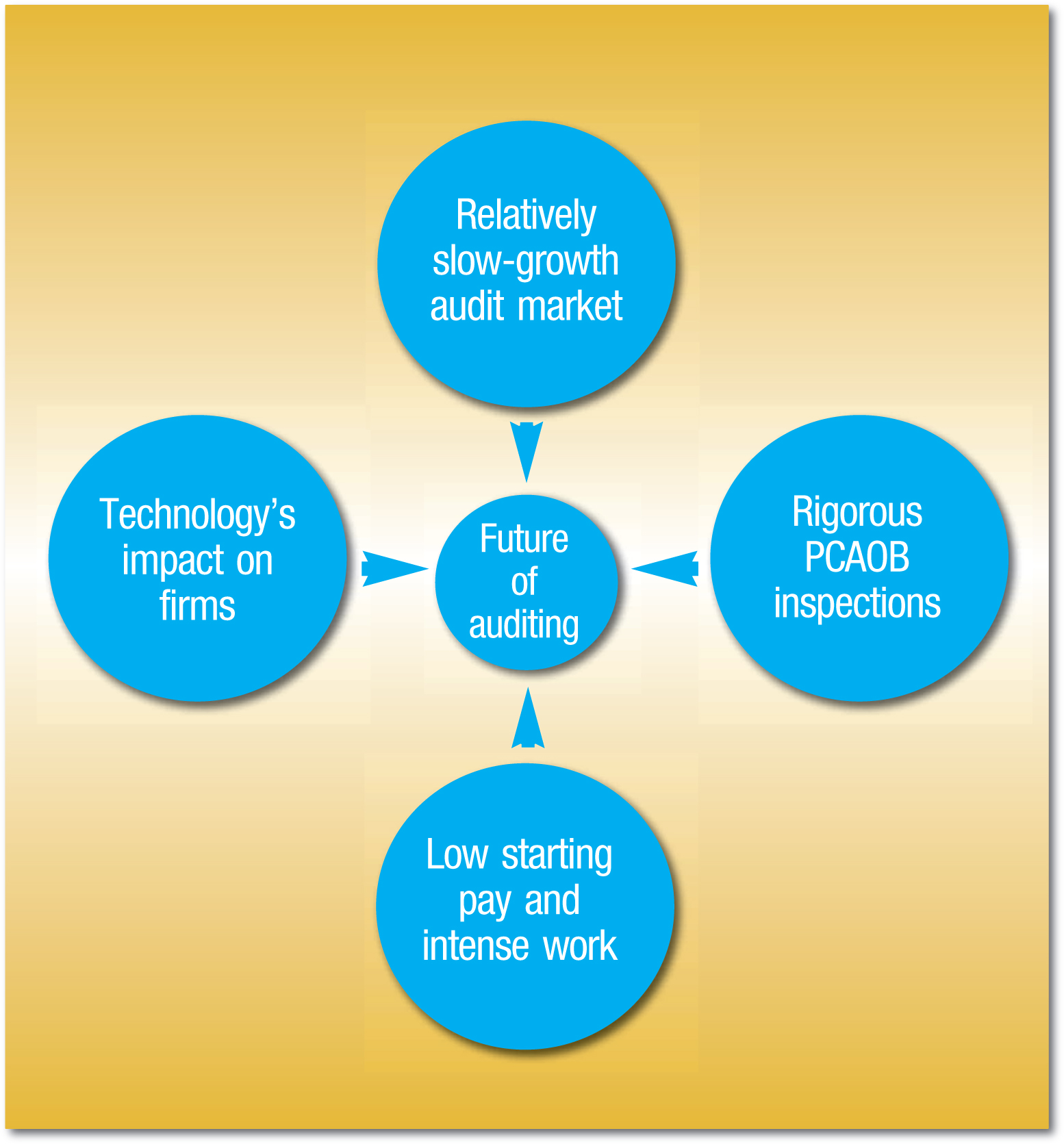

Where Is Public Company Auditing Headed The Cpa Journal

Navigating The Puzzle C Corporation Vs S Corporation Considerations For Financial Institutions Forvis

Big 4 Accounting Firms Ranking Revenue And Salary Igotanoffer

Accounting Tax Audit Consulting Services Sikich Llp

Audit Tax Consulting Financial Advisory Services Grant Research And Grant Proposal Writing